Saving For A New Home

Know your savings options...

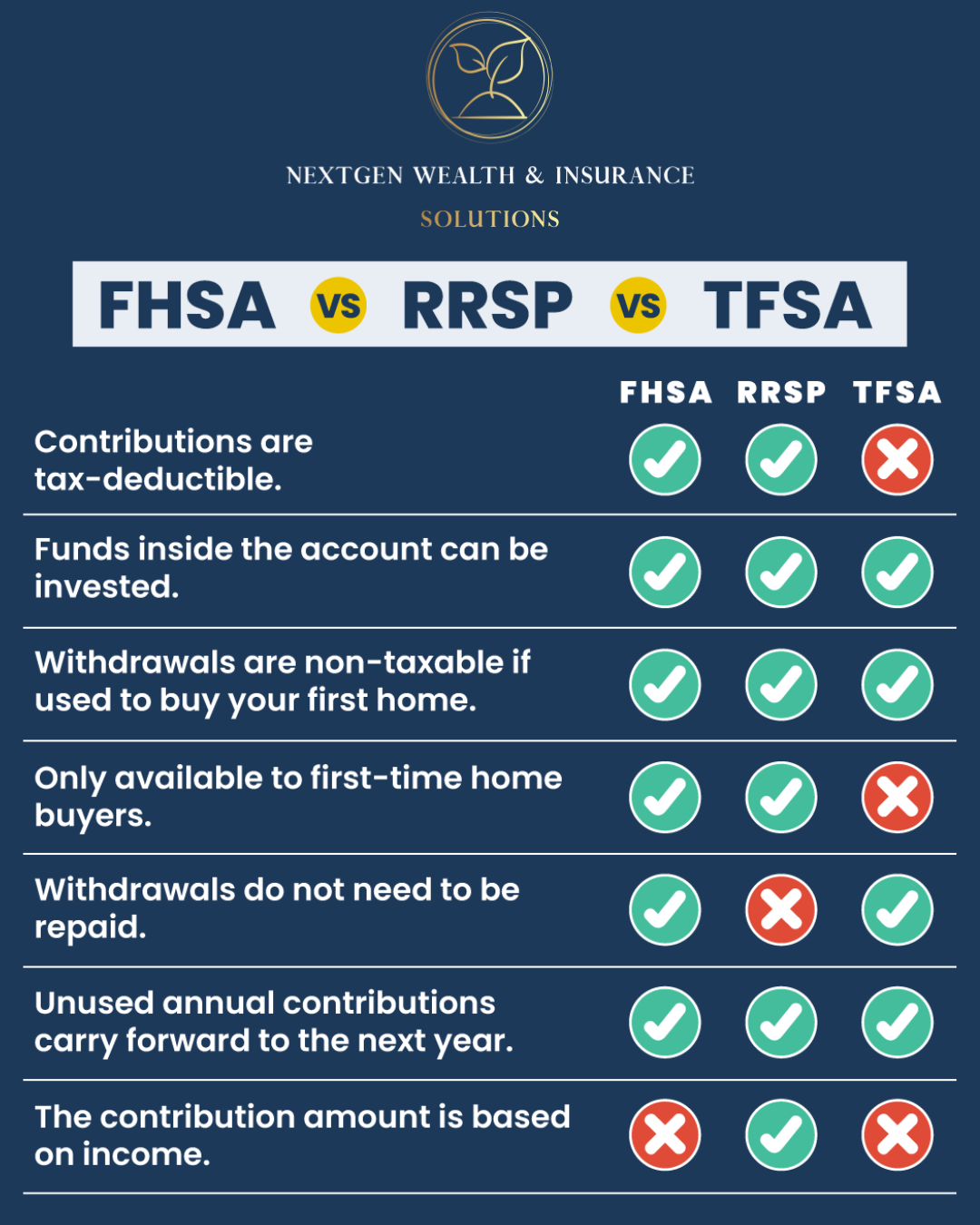

Saving for a New Home: FHSA, TFSA, and RRSP Compared

Buying a new home is an exciting milestone, but it requires a solid financial plan. If you're considering how to save effectively for a down payment, you might be weighing the benefits of various savings accounts.

In Canada, the First Home Savings Account (FHSA), Tax-Free Savings Account (TFSA), and Registered Retirement Savings Plan (RRSP) each offer unique advantages for this purpose. Here’s a breakdown of each option to help you determine which might be the best fit for your home-buying goals.

1. First Home Savings Account (FHSA):

The FHSA is a relatively new savings tool designed specifically for first-time home buyers. It combines features of both the TFSA and RRSP, making it a powerful option for those looking to purchase their first property.

Key Features:

- Contribution Limit: You can contribute up to $8,000 per year, with a lifetime limit of $40,000.

- 15 years is the total amount of time you have to use your FHSA (from the day you open account) or until the age of 71, whichever comes first.

- Tax Benefits: Contributions are tax-deductible, similar to RRSP contributions. This means you can reduce your taxable income for the year you make contributions.

- Withdrawals: Withdrawals used for purchasing a first home are tax-free, like with a TFSA.

- Growth: Investment growth within the FHSA is tax-free, providing the same benefit as the TFSA.

- NOTE: You actually can still access the FHSA if you have not owned a home in the last 4 calendar years (or lived in a home your partner owns)!!

Pros:

- Tax-Deductible Contributions: Can lower your taxable income, giving you a potential refund.

- Tax-Free Withdrawals: No tax on withdrawals for qualifying home purchases.

- Dual Benefit: Combines the best features of TFSA and RRSP, making it a highly attractive option.

Cons:

- Eligibility: Only available to first-time home buyers, so if you’ve owned a home before, you’re not eligible.

- Contribution Limits: Lower annual and lifetime contribution limits compared to TFSA and RRSP.

2. Tax-Free Savings Account (TFSA):

The TFSA is a versatile savings vehicle that offers tax-free growth and withdrawals. It’s not specific to home buying, but it can be an excellent tool for saving for a down payment.

Key Features:

- Contribution Limit: As of 2024, the annual contribution limit is $7,500, with a cumulative lifetime limit that increases yearly.

- Tax Benefits: Contributions are made with after-tax dollars, so you don’t get a tax deduction, but growth and withdrawals are tax-free.

- Flexibility: Funds can be used for any purpose, including buying a home.

Pros:

- Tax-Free Growth and Withdrawals: No taxes on the money you earn or withdraw.

- Flexibility: Use the funds for any purpose, not just home buying.

- No Restrictions: Unlike the FHSA, you don’t need to be a first-time home buyer to use the funds.

Cons:

- Contribution Limits: Annual and cumulative limits might be lower than what you need for a large down payment.

- No Tax Deduction: Contributions don’t reduce your taxable income.

3. Registered Retirement Savings Plan (RRSP):

The RRSP is traditionally used for retirement savings, but it can also be utilized for home buying through the Home Buyers' Plan (HBP).

Key Features:

- Contribution Limit: For 2024, you can contribute up to 18% of your earned income to a maximum of $31,560.

- Tax Benefits: Contributions are tax-deductible, which can reduce your taxable income and potentially provide a tax refund.

- Withdrawals: You can withdraw up to $35,000 from your RRSP for a first-time home purchase under the HBP, but you must repay this amount over 15 years.

Pros:

- Tax Deduction: Contributions can reduce your taxable income, which might be beneficial for your current financial situation.

- Higher Contribution Limits: Allows for larger amounts to be saved compared to TFSA and FHSA.

Cons:

- Repayment Requirement: Withdrawn funds must be repaid to the RRSP over 15 years, which could be a financial burden.

- Tax Implications on Repayments: Failure to repay according to the HBP schedule results in the amount being added to your taxable income.

Choosing the right savings account for your new home depends on your individual financial situation and goals:

- FHSA: Ideal if you’re a first-time home buyer looking for a blend of tax-deductible contributions and tax-free withdrawals.

- TFSA: Great for flexibility and tax-free growth if you’re saving for a down payment without the need for tax deductions.

- RRSP: Suitable if you want to leverage tax-deductible contributions and are comfortable with the repayment plan under the HBP.

Each option has its own set of advantages, so consider your current tax situation, eligibility, and long-term financial goals when deciding where to park your savings. Regardless of which account you choose, starting early and consistently saving will be key to making your home-buying dreams a reality. Reach out to me for a discussion on which might suit your needs best.